Need capital to scale your business in 2026?

Need Capital To Grow Your Business in 2026?

Need Extra Capital for Growth?

We'll help you secure up to $500,000 in low to 0% APR capital in 30-90 days

"No questions asked."

We'll help you secure up to $250,000 at low to 0% interest in 30-90 days using our

"Capital Infrastructure Playbook"

We'll help you secure up to $500,000 in low to 0% APR capital in 30-90 days

"No questions asked."

No more guessing on applications and praying for approvals, time to apply the right way get the funding you need

With our proven system we build you a "lendable" profile so you can access capital on demand. No more guessing, using high interest cards, or burning your cash reserves for growth.

Schedule a call with a funding specialist.

→ No credit check required

→ Just a few quick questions

→ Know exactly how much you qualify for

→ We will never share your information with third parties

Real Testimonials

Real Testimonials

Real Testimonials

Real Results. Predictable Approvals.

6-7 figure business owners who followed the sequence, and watched approvals compound instead of stall.

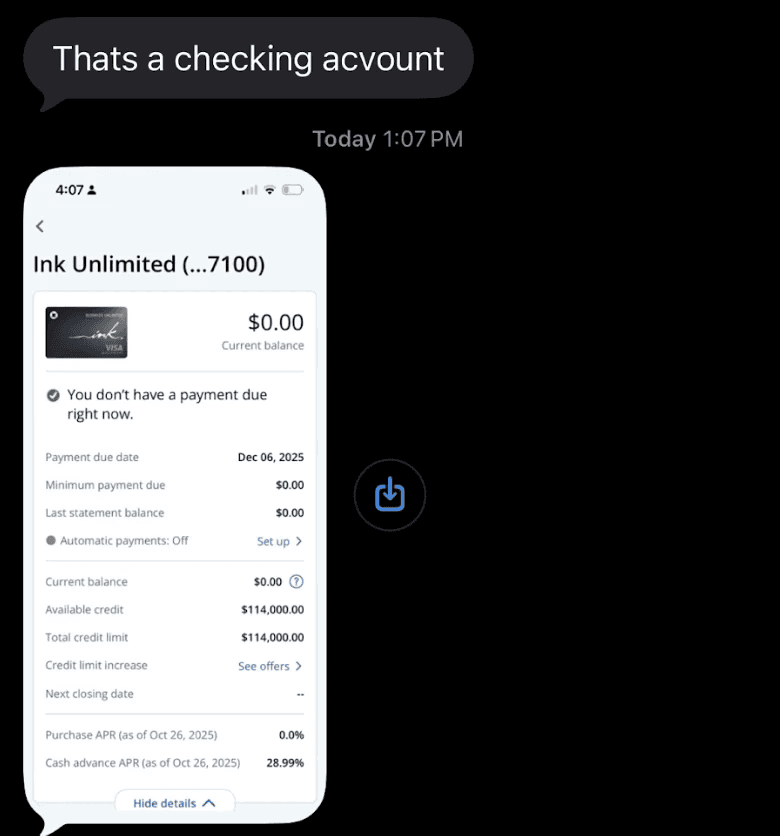

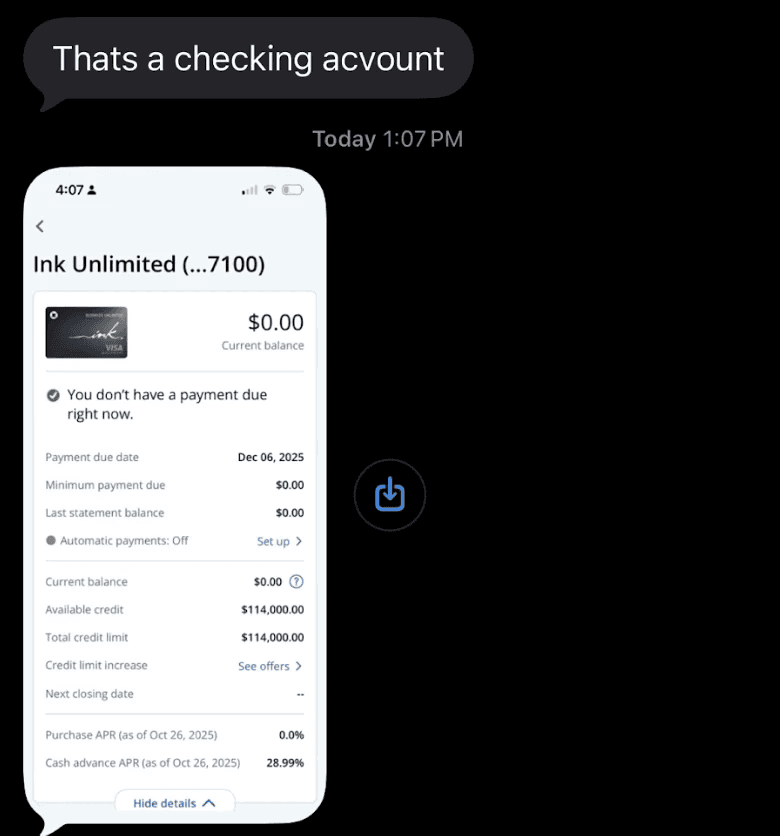

Dylan’s $114,000 Helped Him Scale His Business to 1.2M Yearly

114K

0% Funding Secured

43 Days

Time to Approval

Dylan’s $114,000 Helped Him Scale His Business to 1.2M Yearly

114K

0% Funding Secured

43 Days

Time to Approval

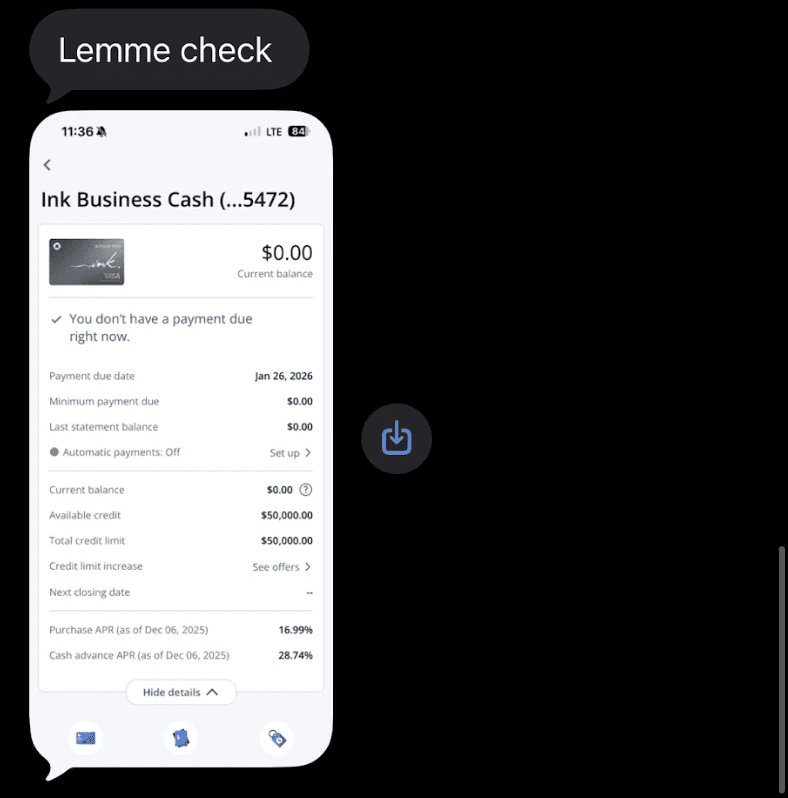

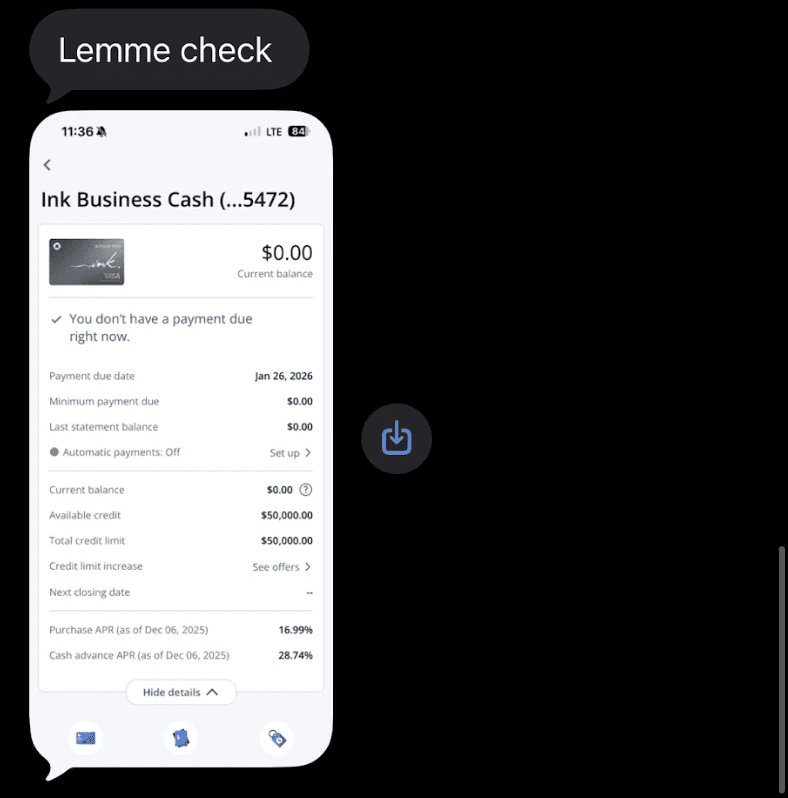

Ethan Secured $50,000 On His First Approval, Giving Him The Safety net he needed

50K

0% Funding Secured

26 Days

Time to Approval

Ethan Secured $50,000 On His First Approval, Giving Him The Safety net he needed

50K

0% Funding Secured

26 Days

Time to Approval

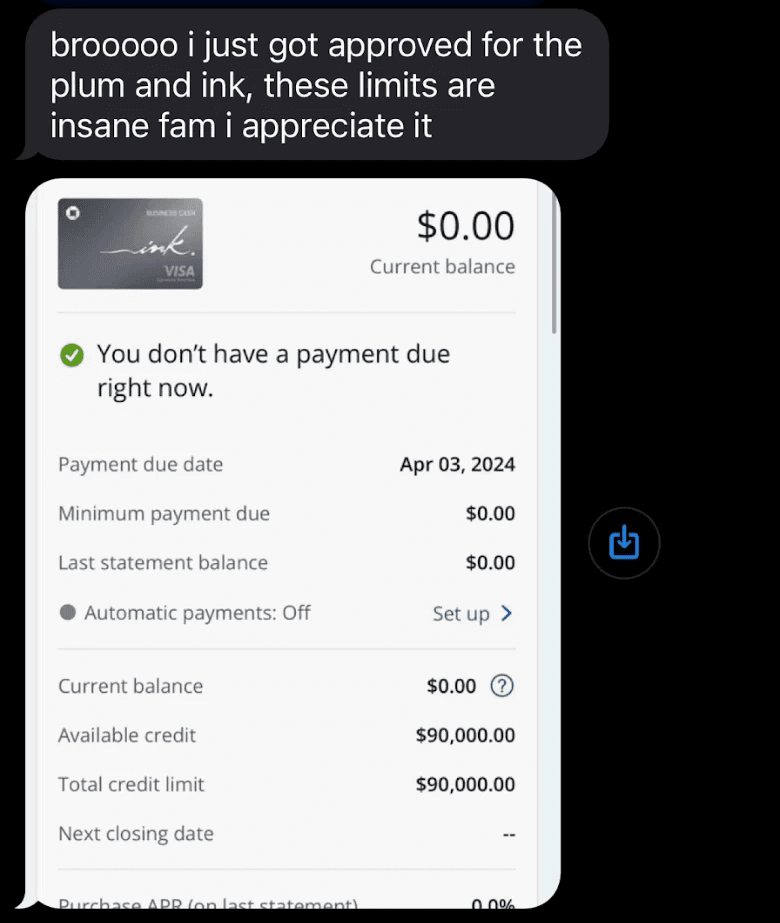

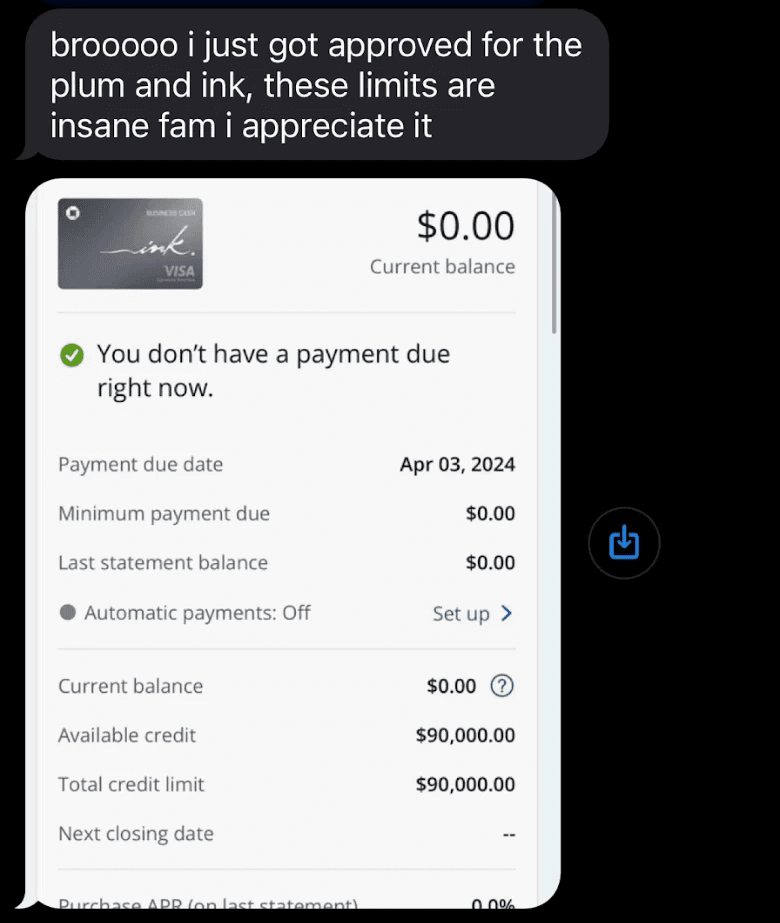

Gamard Got $90K For His Amazon Business, He 3xd His Revenue in 90 days after

90K

0% Funding Secured

22 Days

Time to Approval

Gamard Got $90K For His Amazon Business, He 3xd His Revenue in 90 days after

90K

0% Funding Secured

22 Days

Time to Approval

300+

Trusted clients

300+

Trusted clients

300+

Trusted clients

$19.2M

Secured

$19.2M

Secured

$19.2M

Secured

3 Year

Track Record

3 Year

Track Record

3 Year

Track Record

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.

The System

The System

The System

The System Behind the Approvals

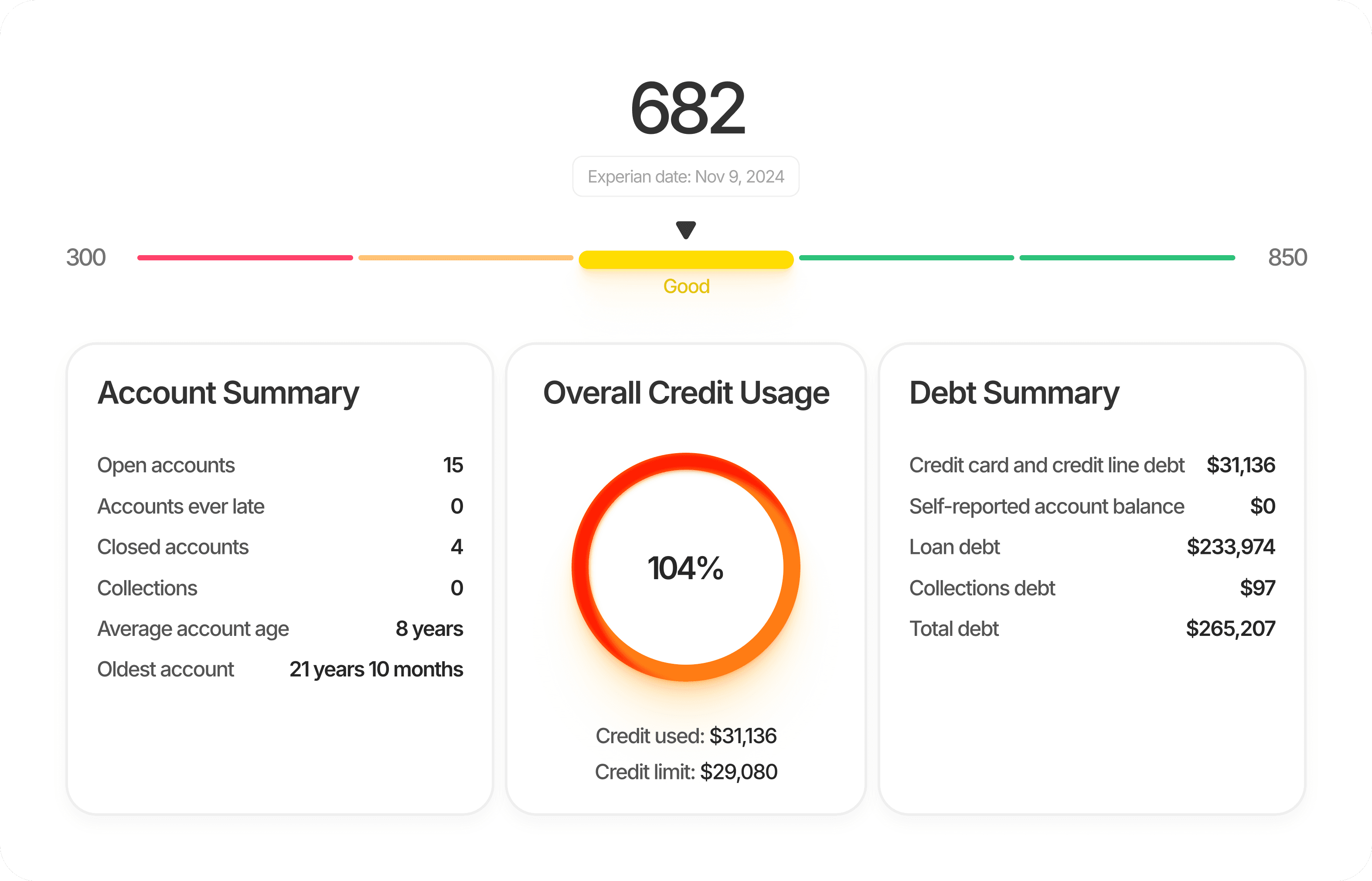

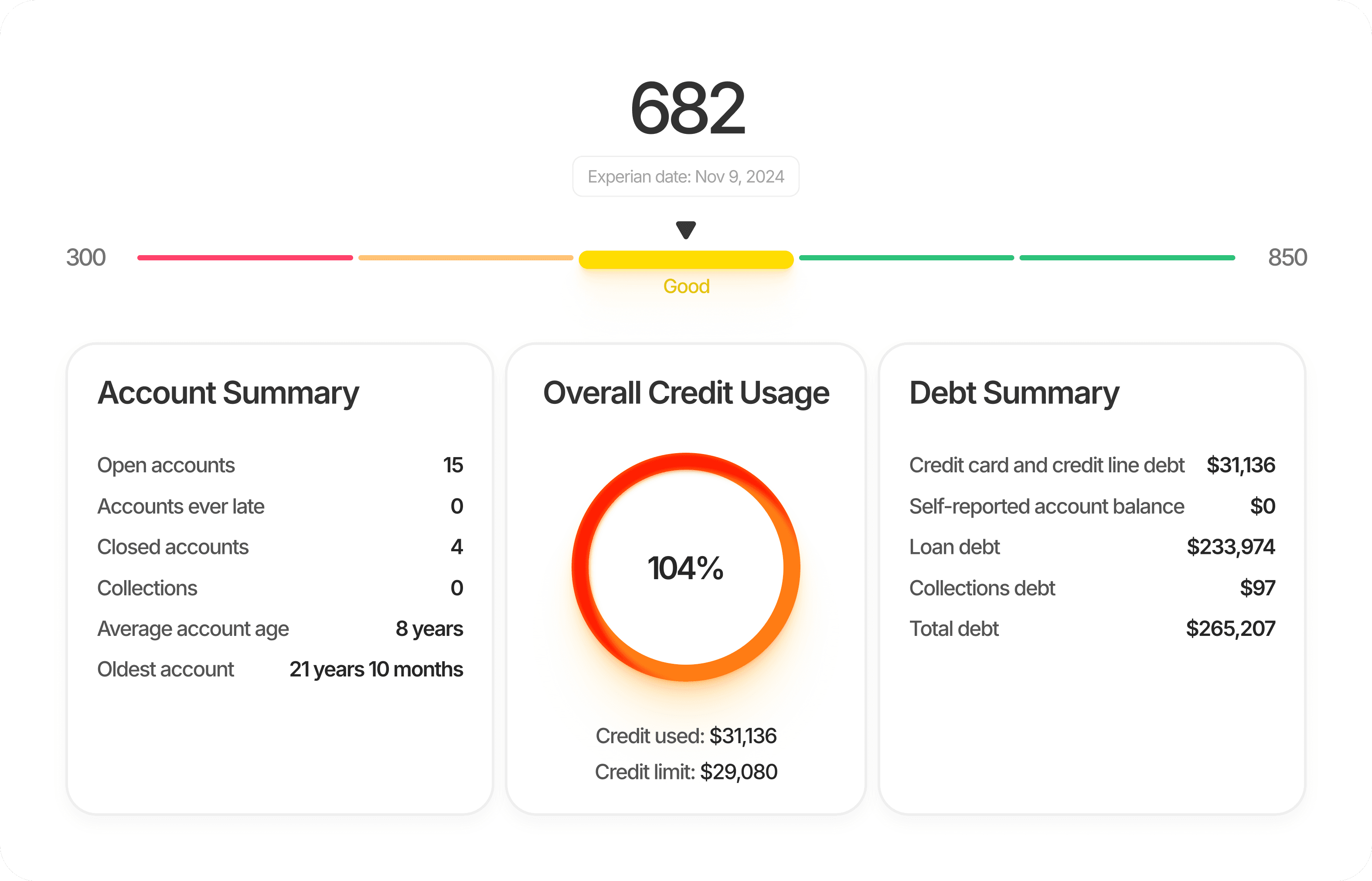

We engineer approvals through optimization, timing, and sequencing, not guesswork.

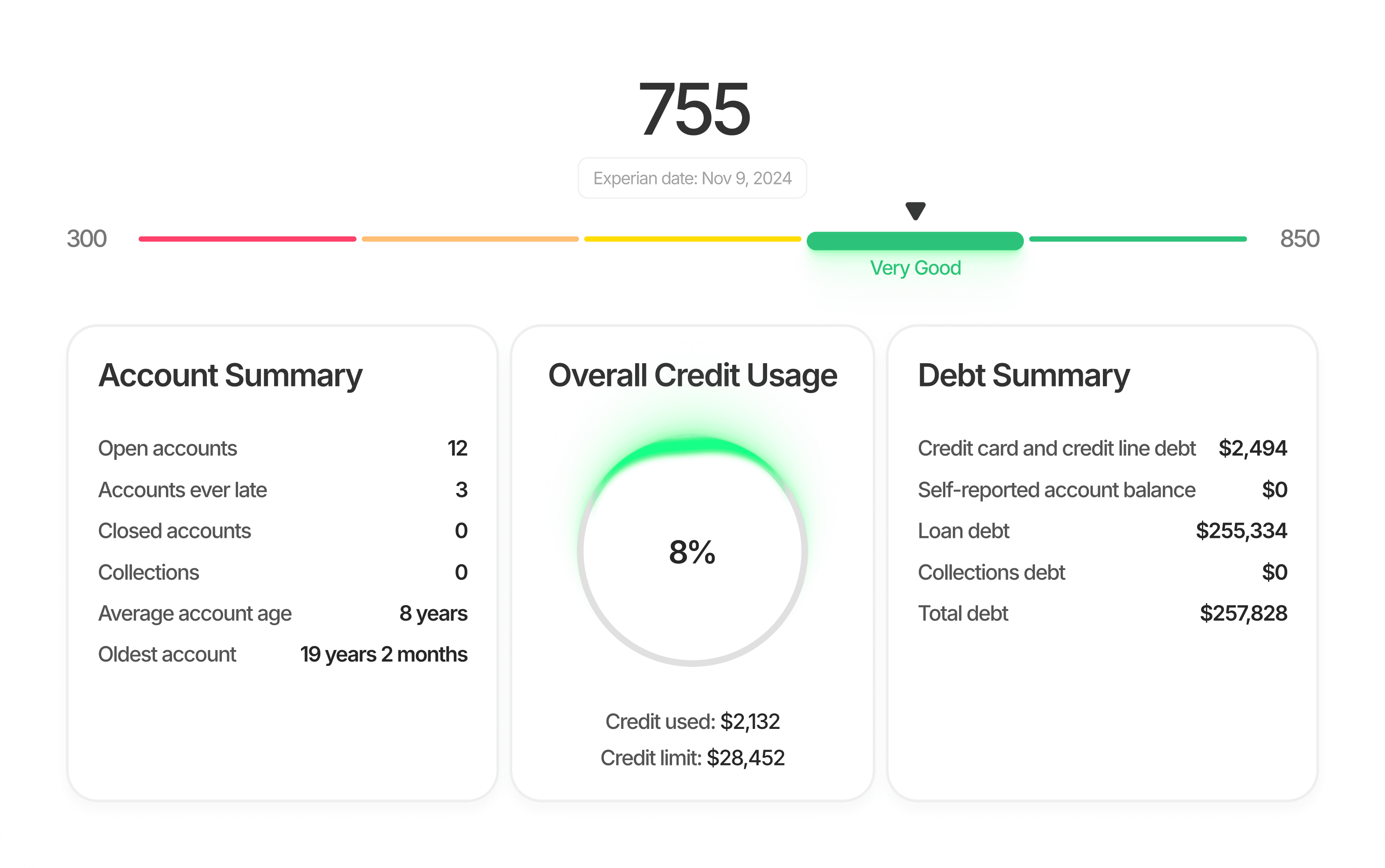

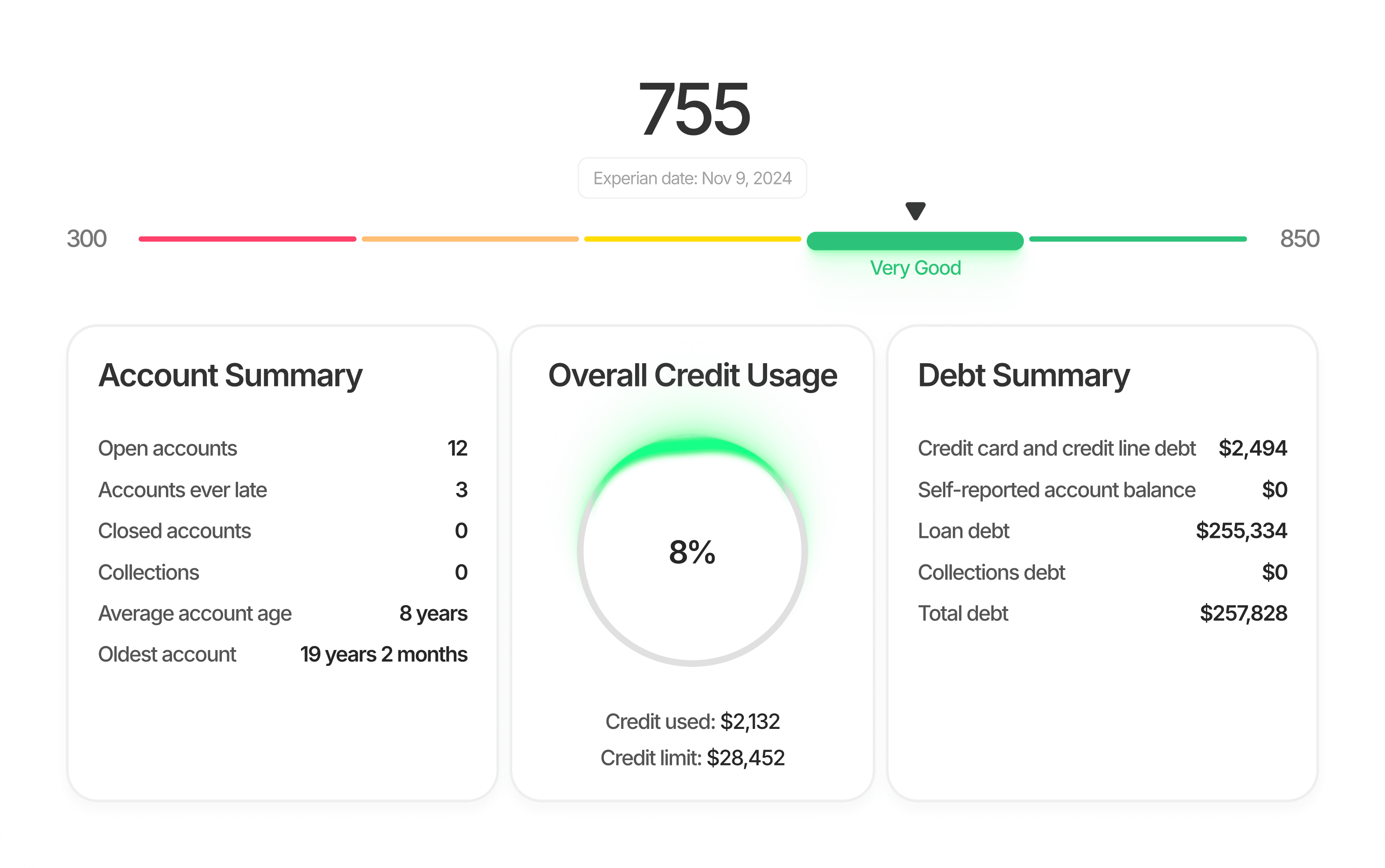

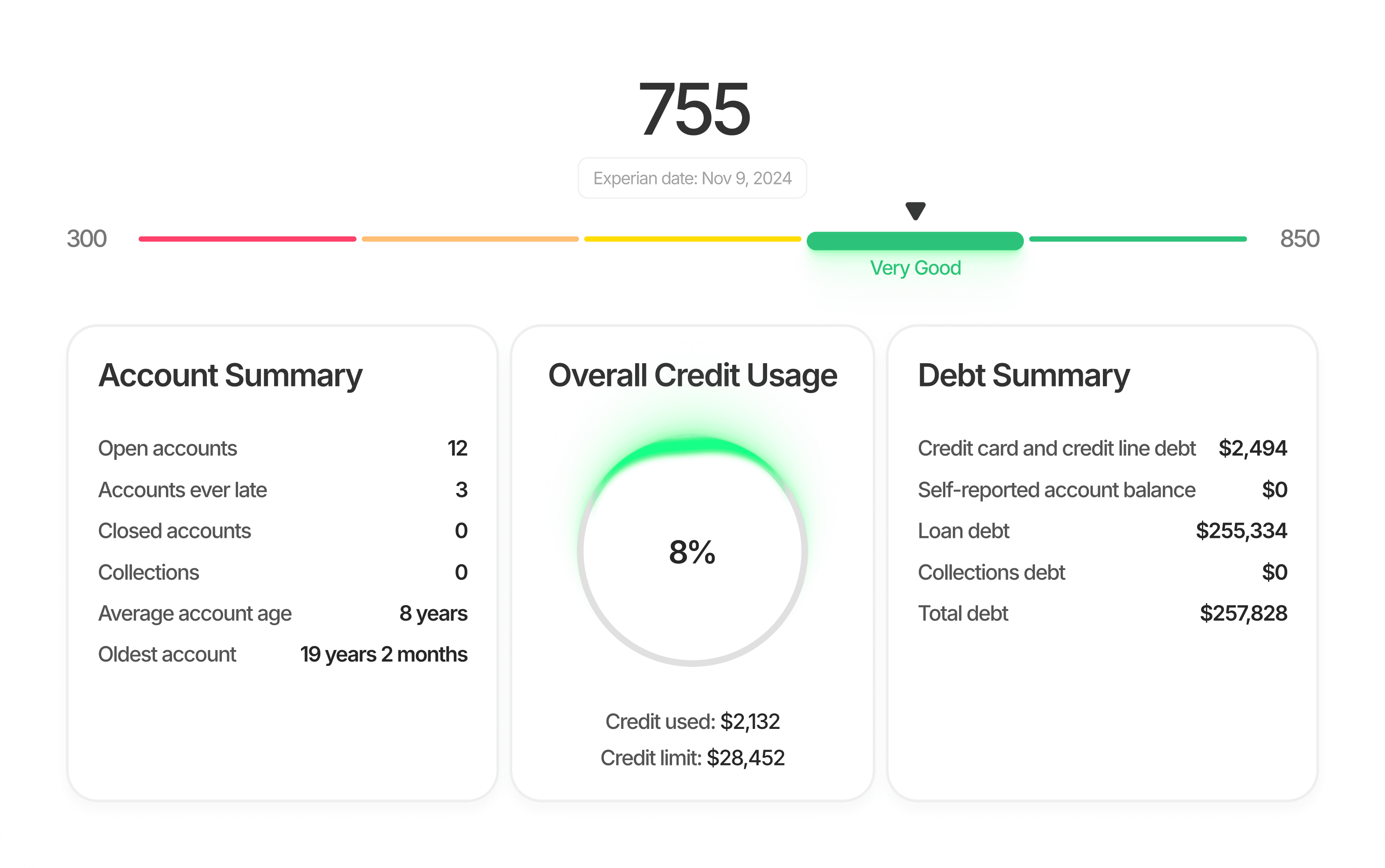

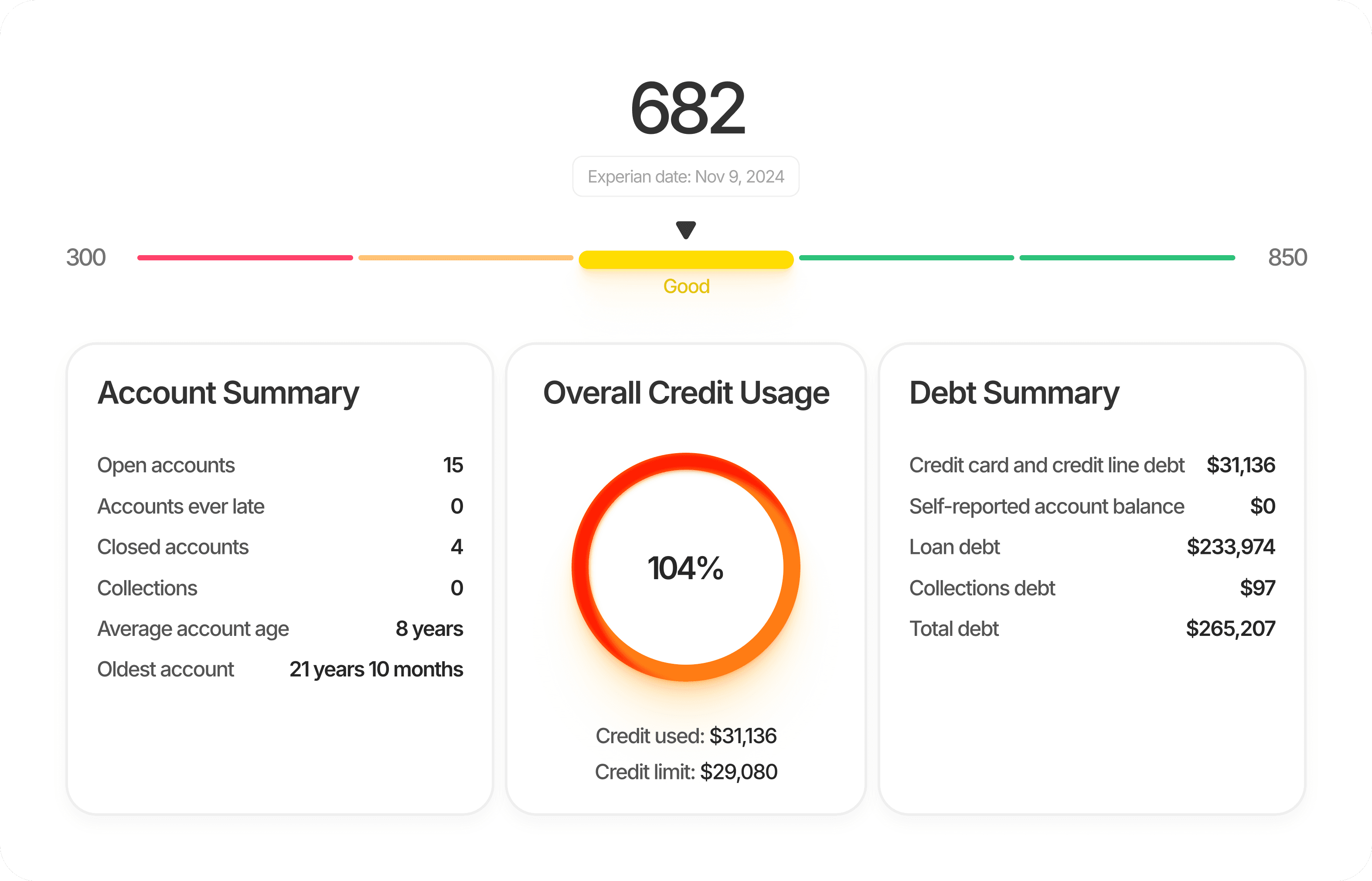

The Funding Audit

We audit your business structuring, your personal credit, and we reveal every single rejection killer and optimize for maximum approvals

The Funding Audit

We audit your business structuring, your personal credit, and we reveal every single rejection killer and optimize for maximum approvals

The Optimization Process

We restructure your business setup, and make sure your personal profile is clean, and application ready

The Optimization Process

We restructure your business setup, and make sure your personal profile is clean, and application ready

The Application Sequencing

We structure you a tailored gameplan and sequencing strategy for your exact business, and personal credit setup. We prepare your profile to be bankable on demand for years to come

The Application Sequencing

We structure you a tailored gameplan and sequencing strategy for your exact business, and personal credit setup. We prepare your profile to be bankable on demand for years to come

Leveraging Our Banking Relationships

We have built up a great reputation with the biggest intitutions and have a private network on VP bankers who run our applications directly optimizing for maximum approvals

Leveraging Our Banking Relationships

We have built up a great reputation with the biggest intitutions and have a private network on VP bankers who run our applications directly optimizing for maximum approvals

We Set You Up For The Long Game

We all know 0% apr capital is a short term fix, and you need a truly bankable business. We don't just get you the interest free funding, we help setup your business for long term funding like SBAs, BLOCs, and other low interst options

We Set You Up For The Long Game

We all know 0% apr capital is a short term fix, and you need a truly bankable business. We don't just get you the interest free funding, we help setup your business for long term funding like SBAs, BLOCs, and other low interst options

We Give You Our Exact Playbook

We not only will be working with you side by side, but we will be teaching you all of the valuable information so you can leverage these skills for years to come

We Give You Our Exact Playbook

We not only will be working with you side by side, but we will be teaching you all of the valuable information so you can leverage these skills for years to come

The Funding Audit

We audit your business structuring, your personal credit, and we reveal every single rejection killer and optimize for maximum approvals

Leveraging Our Banking Relationships

We have built up a great reputation with the biggest intitutions and have a private network on VP bankers who run our applications directly optimizing for maximum approvals

The Optimization Process

We restructure your business setup, and make sure your personal profile is clean, and application ready

We Set You Up For The Long Game

We all know 0% apr capital is a short term fix, and you need a truly bankable business. We don't just get you the interest free funding, we help setup your business for long term funding like SBAs, BLOCs, and other low interst options

The Application Sequencing

We structure you a tailored gameplan and sequencing strategy for your exact business, and personal credit setup. We prepare your profile to be bankable on demand for years to come

We Give You Our Exact Playbook

We not only will be working with you side by side, but we will be teaching you all of the valuable information so you can leverage these skills for years to come

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.

Real Testimonials

Real Testimonials

Real Testimonials

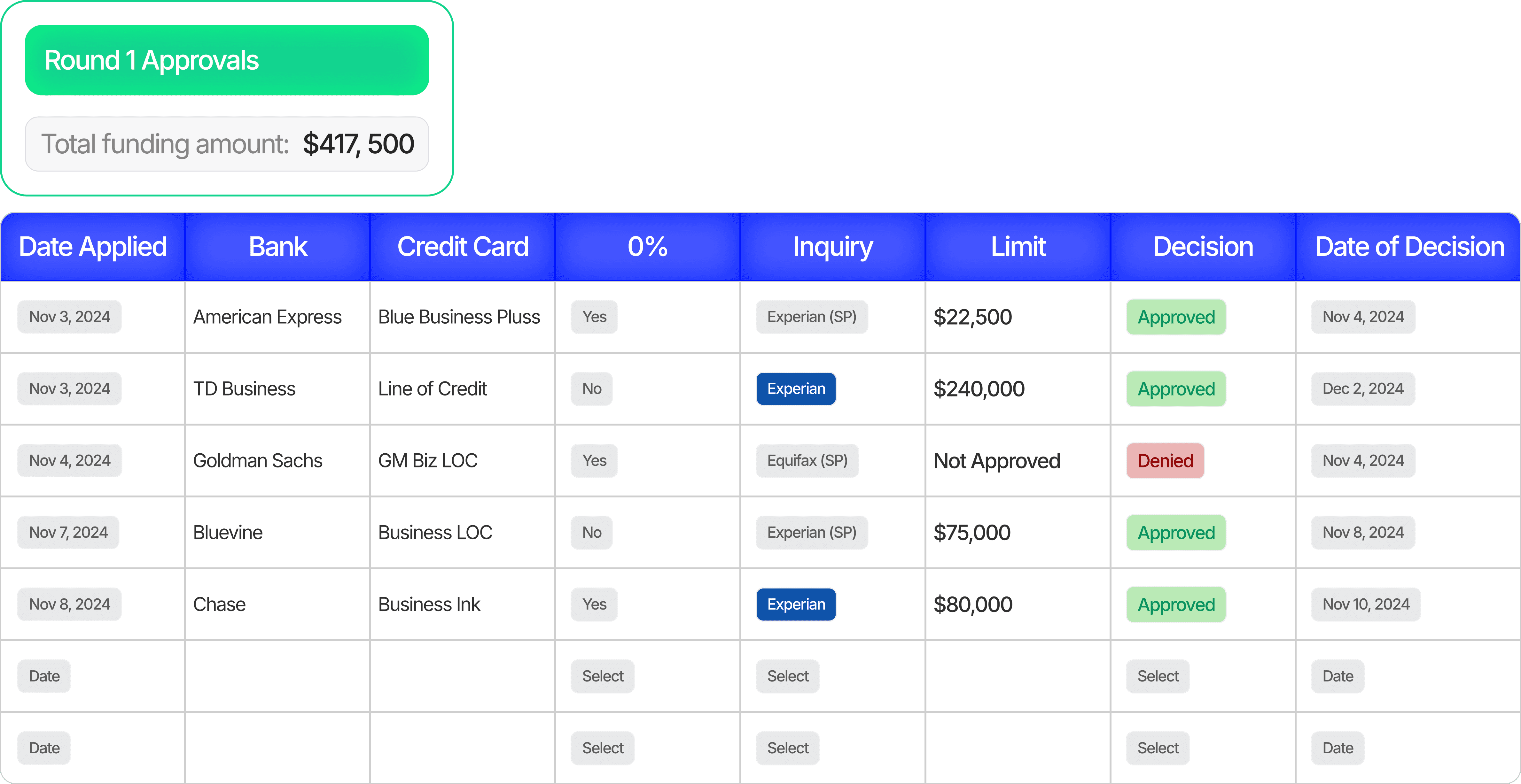

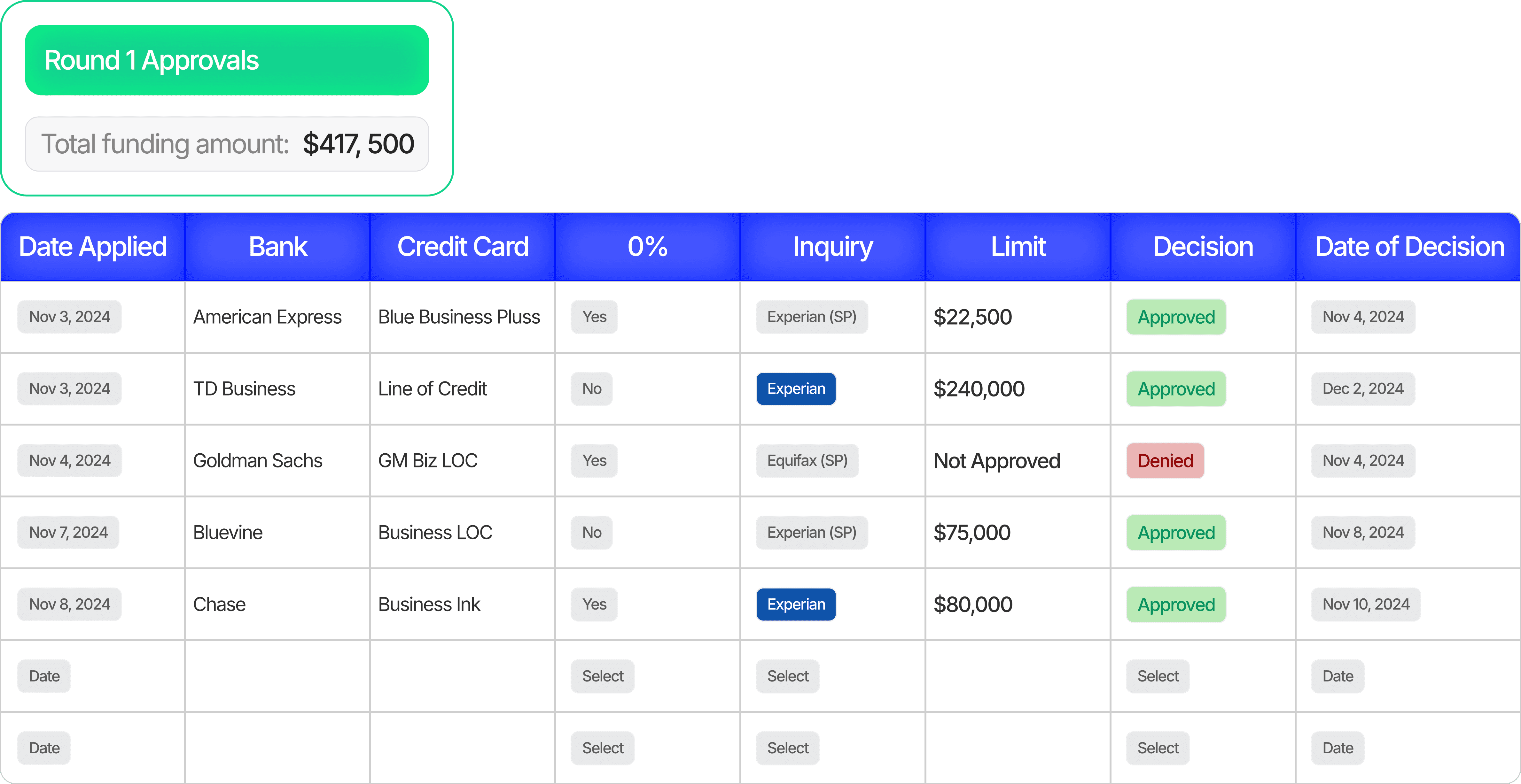

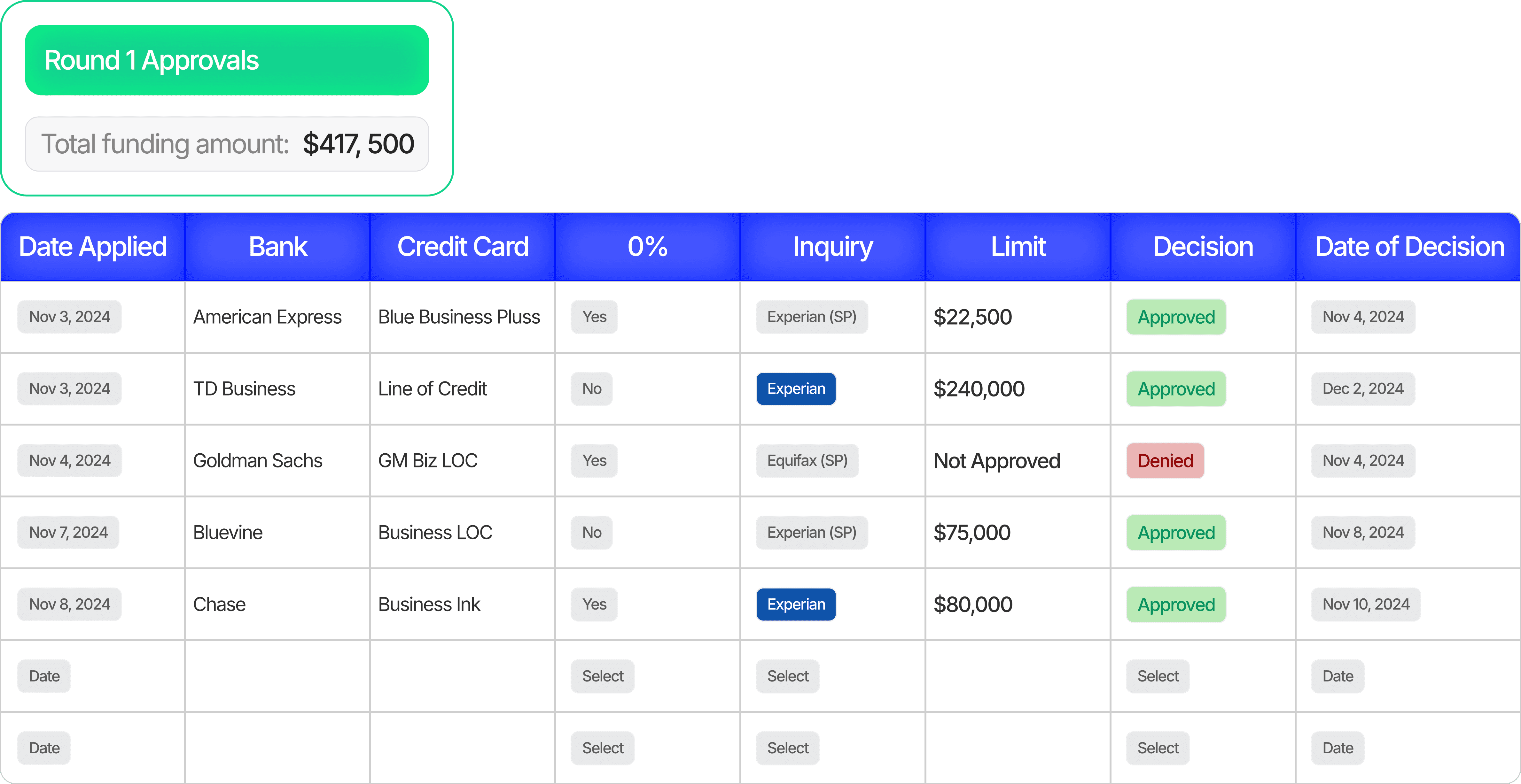

Approvals From Real Clients

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.

How It Works

How It Works

How It Works

How Approvals Are Engineered Not Guessed

A step-by-step system that turns one approval into cascading access to six-figure capital, without guesswork or credit damage.

1

It's no longer just as easy as having a 700+credit score anymore. Banks require legimate business structuring, and an optimized personal profile

3

Our network of insider bankers who run our applications directly are able to send applications directly to the underwirters making your approvals larger and faster

5

We know these are business credit cards, and thats also exactly why we can show you how to liquidate them for very minimal fees to turn it into hard cash if needed

2

We have specefic sets of data points we use per the different banks. Not having these could be the difference of securing $5000, to $50,000+

4

Applying in the wrong order can set you back for months. Each bank pulls a different credit bureau, and if your not planning this out, it could mess up your future rounds of funding

6

Being bankable matters, as a business owner its a skill in its own to be able to access capital on demand, and thats exactly what we do at Scale With Credit

1

It's no longer just as easy as having a 700+credit score anymore. Banks require legimate business structuring, and an optimized personal profile

2

We have specefic sets of data points we use per the different banks. Not having these could be the difference of securing $5000, to $50,000+

3

Our network of insider bankers who run our applications directly are able to send applications directly to the underwirters making your approvals larger and faster

4

Applying in the wrong order can set you back for months. Each bank pulls a different credit bureau, and if your not planning this out, it could mess up your future rounds of funding

5

We know these are business credit cards, and thats also exactly why we can show you how to liquidate them for very minimal fees to turn it into hard cash if needed

6

Being bankable matters, as a business owner its a skill in its own to be able to access capital on demand, and thats exactly what we do at Scale With Credit

1

It's no longer just as easy as having a 700+credit score anymore. Banks require legimate business structuring, and an optimized personal profile

2

We have specefic sets of data points we use per the different banks. Not having these could be the difference of securing $5000, to $50,000+

3

Our network of insider bankers who run our applications directly are able to send applications directly to the underwirters making your approvals larger and faster

4

Applying in the wrong order can set you back for months. Each bank pulls a different credit bureau, and if your not planning this out, it could mess up your future rounds of funding

5

We know these are business credit cards, and thats also exactly why we can show you how to liquidate them for very minimal fees to turn it into hard cash if needed

6

Being bankable matters, as a business owner its a skill in its own to be able to access capital on demand, and thats exactly what we do at Scale With Credit

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.

Next Steps

Next Steps

Next Steps

What Happens Next

Ready to see your custom funding blueprint?

1

You book your funding call with us, we have a Funding Specalist analyze and audit your profile, and find those application killers within 10 minutes.

2

We audit your business and personal profile across all 3 bureaus, then show you exactly what is holding you back from accessing 6 figure approvals

3

We present your funding blueprint, with exact sequences and a custom gameplan tailored to your business

4

If you’re a fit, we begin optimization within 48 hours. No pressure, just clarity on accessing $50K–$250K in strategic leverage without damaging your credit.

1

You book your funding call with us, we have a Funding Specalist analyze and audit your profile, and find those application killers within 10 minutes.

3

We present your funding blueprint, with exact sequences and a custom gameplan tailored to your business

2

We audit your business and personal profile across all 3 bureaus, then show you exactly what is holding you back from accessing 6 figure approvals

4

If you’re a fit, we begin optimization within 48 hours. No pressure, just clarity on accessing $50K–$250K in strategic leverage without damaging your credit.

1

You book your funding call with us, we have a Funding Specalist analyze and audit your profile, and find those application killers within 10 minutes.

3

We present your funding blueprint, with exact sequences and a custom gameplan tailored to your business

2

We audit your business and personal profile across all 3 bureaus, then show you exactly what is holding you back from accessing 6 figure approvals

4

If you’re a fit, we begin optimization within 48 hours. No pressure, just clarity on accessing $50K–$250K in strategic leverage without damaging your credit.

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.

They found the single hidden issue blocking every approval I’d tried for months. Fixed it fast, and suddenly I was getting real limits instead of constant denials

Laura S.

E-commerce Owner

They found the single hidden issue blocking every approval I’d tried for months. Fixed it fast, and suddenly I was getting real limits instead of constant denials

Laura S.

E-commerce Owner

I never realized timing mattered this much. Their sequence got me approved by three major banks at 0% back-to-back, something I never thought possible with my profile.

Sofia M.

Project Manager

I never realized timing mattered this much. Their sequence got me approved by three major banks at 0% back-to-back, something I never thought possible with my profile.

Sofia M.

Project Manager

Their 4-bureau scan revealed errors no other company even checked. Once they corrected them, the funding offers began showing up far larger and far faster than expected.

Kevin D.

Startup Founder

Their 4-bureau scan revealed errors no other company even checked. Once they corrected them, the funding offers began showing up far larger and far faster than expected.

Kevin D.

Startup Founder

In just 14 days I received more approvals than I had in the entire previous year. Their sequencing strategy finally made the banks see me as a priority borrower.

Adam C.

Contractor

In just 14 days I received more approvals than I had in the entire previous year. Their sequencing strategy finally made the banks see me as a priority borrower.

Adam C.

Contractor

They found the single hidden issue blocking every approval I’d tried for months. Fixed it fast, and suddenly I was getting real limits instead of constant denials

Laura S.

E-commerce Owner

I never realized timing mattered this much. Their sequence got me approved by three major banks at 0% back-to-back, something I never thought possible with my profile.

Sofia M.

Project Manager

Their 4-bureau scan revealed errors no other company even checked. Once they corrected them, the funding offers began showing up far larger and far faster than expected.

Kevin D.

Startup Founder

In just 14 days I received more approvals than I had in the entire previous year. Their sequencing strategy finally made the banks see me as a priority borrower.

Adam C.

Contractor

From Cold to Warm

From Cold to Warm

From Cold to Warm

How We Turn Your Business Into a Bankable Asset in Just A Few Days.

How we make your business truly "bankable"

By fixing hidden risk signals and sequencing applications correctly, approvals follow as a result, not a gamble.

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.

FAQs

FAQs

FAQs

Questions Business Owners Ask Before Engaging

Free funding audit, see your exact approval odds within 48 hours, no hard credit checks required

How is this different from business credit cards I could apply for myself?

How is this different from business credit cards I could apply for myself?

How is this different from business credit cards I could apply for myself?

What credit score do I actually need?

What credit score do I actually need?

What credit score do I actually need?

How long does this actually take?

How long does this actually take?

How long does this actually take?

How much capital can I realistically access?

How much capital can I realistically access?

How much capital can I realistically access?

What do liquidation fees actually cost?

What do liquidation fees actually cost?

What do liquidation fees actually cost?

Will this hurt my credit?

Will this hurt my credit?

Will this hurt my credit?

Do I need an LLC or specific business structure?

Do I need an LLC or specific business structure?

Do I need an LLC or specific business structure?

What if I already have business credit cards?

What if I already have business credit cards?

What if I already have business credit cards?

What happens after Round 1?

What happens after Round 1?

What happens after Round 1?

How selective are you with clients?

How selective are you with clients?

How selective are you with clients?

Our Team

Our Team

Our Team

Meet Our Team

A team of experienced professionals committed to excellence, transparency, and results.

Hunter

CEO

Hunter

CEO

Hunter

CEO

Danny

COO

Danny

COO

Danny

COO

Ross Petras

Director of Funding

Ross Petras

Director of Funding

Ross Petras

Director of Funding

See your exact Approval Amount and a clear path to $50K–$250K in 0% business capital.